Usaa Career Starter Loan Amount

The amount of the usaa cadet loan is usually $25,000 to $36,000. Things i can use my usaa loan for

Why choose a usaa career starter loan?

Usaa career starter loan amount. 12, 24, 36, or 48, 60, 84 months; The loan amounts range from $25,000 to $35,000 with interest of only 0.5% to 2.99%. Usaa encourages healthy life style for their employees by providing discounts on healthy food options and a free onsite gym.

Our mortgage loans have a $50,000 minimum loan amount requirement, excluding jumbo. The amount of money cannot be useful instructional spending. As of now, my credit score is 730ish.i have recently been approved for the usaa career starter loan which is $25,0000 with an apr of 2.99%.

Usaa and navy federal credit union (nfcu) offer 'career starter loans' to newly commissioned officers. Read our review of usaa loans and compare with other lenders. Usaa believes the career starter loan offers a great opportunity to get you started on the right foot financially at a very low cost relative to other sources.

The job could be very stressful during purchase season and it was not worth the compensation for me. Usaa believes the career starter loan offers a great opportunity to get you started on the right foot financially at a very low cost relative to other sources. Starting a career means different things to different people, but some common decisions new officers make are paying off debts, buying uniforms which can amount to thousands of dollars, or making leisure purchases.

Usaa is flexible when it comes to offering personal loans. You can apply for a loan for as little as $2,500, and. I’ll never forget the feeling of looking in my checking account and seeing the $25,000 deposit come in.

Usaa career beginner loan faq how do i use the cash? With federal loans, you can pay them back based on your income, so payments will be much lower but you will pay a lot more in interest. Payments are deferred until 6 months after your scheduled commissioning date.

The biggest difference between the two (other than interest rates) is that the usaa loan is paid back over a 5 year period with monthly payments of ~$450. Our low interest rate loans help new officers avoid the burden of high interest debt. Even so, remember that this is a loan that you will have to repay so determine what amount, if any, is appropriate for you to borrow.

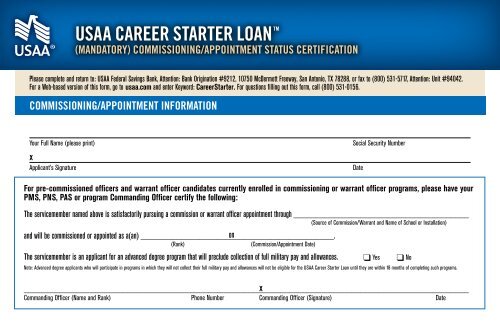

The usaa career starter loan program is offered to cadets and midshipmen commissioning through army, air force, and navy/marines rotc (reserve officer training corps) or through. Even so, remember that this is a loan that you will have to repay so determine what amount, if any, is appropriate for you to borrow. You can choose from a variety of loan amounts and terms when applying for the loan.

You can take any amount of the loan out up to the maximum and there are no early repayment penalties. Personally, if it were me and i already had a car, i would take the loan and invest it for the year. Bank of america student loans:

These loans must be paid back within five years. Similarly i have paid $500 in interest on the 25k usaa career starter loan since last year. I plan to use this loan strictly for investment purposes only (i.e.

My question is, once i. The usaa career starter loan offers newly commissioned officers an opportunity to borrow up to $25,000 to start their career. Max of $36k at.75% with five year payback beginning sept 2016.

Usaa career starter loans are only available to military members who are cadets, midshipmen, or officer candidates. The year was 2003, and i was a 21 year old “second class cadet” at the us coast guard academy. What the usaa career starter loan gets you the loan offers up to $25,000 to help start your career in the military.

The job could be very stressful during purchase season and it was not worth the compensation for me. The united services automobile association (usaa) career starter loan allows for military members, veterans, and associated family members to apply for a loan to pay for career associated expenses. Loans typically range between $25,000 and $35,000 at interest rates at or below 2.99%.

Submit an application for the loan. My only complaint i had as a mortgage loan processor was the compensation for the amount of work. Also, you need no collateral before you can access this career starter loan.

Getting the money you need at a reasonable rate can be a responsible way to build credit as you start your career. My only complaint i had as a mortgage loan processor was the compensation for the amount of work. Keep in mind that a debt consolidation loan from usaa will be worthwhile if it saves you money compared to the interest rates you are paying on your existing debts.

Usaa encourages healthy life style for their employees by providing discounts on healthy food options and a free onsite gym. The loan is scheduled to be paid off in 5 years. Interestingly, there are no penalties for early repayment.

Post a Comment for "Usaa Career Starter Loan Amount"